The ongoing housing recovery that the United States is experiencing seems to be escaping minority groups, the same sector that was hit the hardest by the housing crisis of 2007.

For some, the reasons are racial prejudice, for others the reality of a new market. CCTV’s Nitza Soledad Perez explains.

Minority Groups Facing Hardships Buying Houses in the U.S.

The ongoing housing recovery that the United States is experiencing seems to be escaping minority groups, the same sector that was hit the hardest by the housing crisis of 2007.After filing for bankruptcy, due to the financial impact of her divorce, Regina Joyce, an employee of the Miami Dade School board was unable to get a mortgage.

Not even a 29-year tenure at the county school board could get her a loan at her credit union.

Regina Joyce, prospective home buyer, said: “I felt like I was being labeled, that once you make that mistake, once you have bad credit, that they don’t give you a chance, opportunity or nothing to move up to move ahead.”

But even minority groups with good credit, face hardships when trying to buy a home. The city of Miami filed three separate suits against Wells Fargo, Bank of America, and Citigroup, claiming their lending practices violated the federal Fair Housing Act. The city alleges that minority residents were routinely charged higher interest rates than white applicants, regardless of their credit history.

Regina Joyce also told the reporter: “I truly believe if I was a white single female, they would have stopped, they would have gave me that first loan, they would have gave me the opportunity, it would have went through right away.”

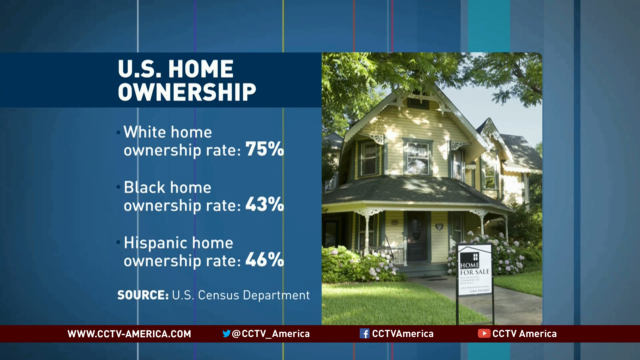

According to a recent U.S. census report on home ownership, white households are getting more benefits of the current housing boom. Their home ownership rate is close to 75%. Black home ownership is about 43% and for Hispanics, it’s 46% — though not all agree that the problem is about race.

George Fraguio, Director of Real Estate and Financing at Fortune International, said: “I think that what’s really happening now is that there is an economic discrimination, where you have a lot of buyers that are first time home buyers, that can’t buy a house because they are competing with cash rich buyers so there is a lot of economic discrimination and is more prevalent here in South Florida.”

On top of that, minorities face a new home mortgage landscape: banks have made it tougher and costlier for risky borrowers to get mortgages

But for those that feel they have been discriminated either by their skin color, their credit history or both, not all is lost: there are some organizations out there willing to assist them, if they are really committed in achieving that American dream.

Rick Herrera, Director of Communications NACA (The Neighborhood Assistance Corporation of America), told the reporter: “Our organization is character based lending. If you show us that you have been a responsible renter for the past two years, that you are in a stable job, not necessarily a doctor, or an attorney or someone who earns six figures that is not what our program is about. Our program is about educating, making sure that you don’t end up on the other side of the foreclosure program.”

With the assistance of this organization, Regina Joyce has been pre- approved for a $145 thousand dollar loan. Despite the odds against her, at 52, she might be able to fulfill the American Dream, that is, if no other buyer with more cash outbids her ambition.

CGTN America

CGTN America