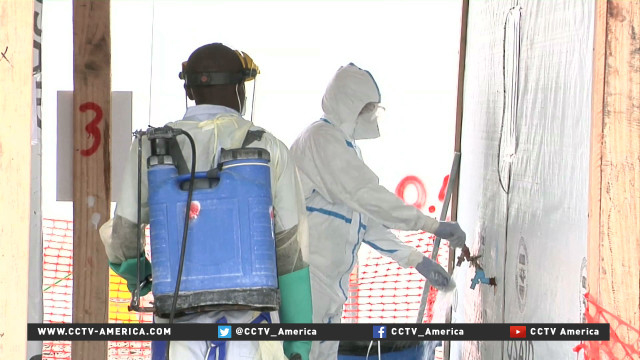

The Ebola outbreak has changed how Africa handles deadly disease outbreaks and it’s forced the continent’s sovereign disaster risk insurer to come up with policies to handle epidemics. CCTV’s Angelo Coppola reported this story from South Africa.

African company develops Ebola insurance product

The Ebola outbreak has changed how Africa handles deadly disease outbreaks and it's forced the continent's sovereign disaster risk insurer to come up with policies to handle epidemics. CCTV's Angelo Coppola reported this story from South Africa.According to the latest data from the Centers for Disease Control and Prevention, more than 9,000 people have died from the Ebola epidemic in Guinea, Liberia, and Sierre Leone. The country’s economies have been decimated, and at beginning of February, the IMF announced debt relief packages for all three countries. African Risk Capacity is working on providing a product that can mitigate some of the economic downside.

“Our policies are not developed yet, but for natural disasters, as a proxy, our drought insurance (will cover), because we have diversity across the continent, and that really brings down the cost of contingency financing. The premiums are set about 10 percent of the cover, so for $30 million of cover of drought insurance you would pay $3 million, approximately, as a country,” Fatima Kassam, chief of staff of African Risk Capacity, said.

The call for an epidemic insurance solution was initially made, because of the devastating Ebola virus, however, it’s not an Ebola-specific product.

“Next time it’s not going to be Ebola. Next time if will be a different virus that lives in the reservoir in some of our countries, and there seems to be two financing needs. One at the outbreak, onset, and others to contain the spread. So we are really looking at a policy that is contextually appropriate for Africa, and meets the needs of our member states,” Kassam said.

CGTN America

CGTN America