U.S. President Donald Trump has put off implementing steel tariffs – for the time being. But lobbying between steel producers and steel users at home – has only intensified.

In a July interview with the Wall Street Journal, he accused other countries of dumping steel in the U.S, but said dealing with the problem would have to wait until lawmakers pass legislation on healthcare, taxes and possibly infrastructure.

CGTN’s Jessica Stone reports.

“We’re waiting till we get everything finished up between health care and taxes and maybe even infrastructure. But we’re going to be addressing the steel dumping at a very – fairly soon,” Trump said.

Steel food cans — The canning industry calls them the most tamper-proof food packaging on the market.

So when the American canning industry caught wind of President Donald Trump’s pledge to slap steel tariffs on trading partners, it sent a letter to the White House, saying: don’t meddle with our metal.

“Even a small increase” would “create further price pressures,” wrote the Can Manufacturing Institute in a letter to the White House.

American steel producers pushed back.

“If our industry continues to be challenged by market distorting foreign competition it could become impossible to procure the steel we need domestically,” Thomas J. Gibson, president and CEO of American Iron & Steel Institute Statement said.

“It helps the steel producing sector, hurts the steel using sector which is much, much larger,” Caroline Freund, a PIIE Trade Expert said.

In fact, Department of Commerce Statistics show, for every one steel production worker here in the United States, there are 16 people whose job depends on making something out of steel. So steel tariffs would not just hit trading partners – but American workers as well.

Trump wants to penalize China for producing more steel than it can use, accusing their overcapacity of depressing global steel prices.

According to the Chinese government, Chinese steel output rose nearly 6 percent in April of this year, above a previous all-time high last spring.

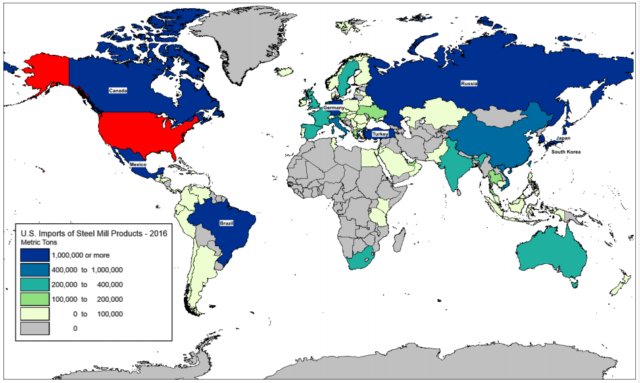

The U.S. imports more steel from Canada, Mexico and Brazil than it does from China. And the U.S. already has tariffs on Chinese steel in compliance with international law.

(Data Source: Global Trade Atlas; Copyright © IHS Global Inc. 2017, via U.S. Department of Commerce)

The problem with Trump’s proposed tariffs, is that he’s justifying them in the name of national security.

That’s against World Trade Organization rules designed to guard against protectionism, says trade expert, Caroline Freund.

“It’s not about defense. it’s about jobs. that’s the real threat to the international system,” said Freund. “We’re using it incorrectly, and breaking international rules: The country that people look to as an example of globalization.”

The better alternative, Freund added, is to build on the G20 communique reached in Hamburg, Germany: getting global agreements to cut down on over-capacity in the steel sector; instead of penalizing trading partners who are not part of the problem.

Dan McClory explains how levy tariffs on China steel exports affect China-US trade

CGTN’s Rachelle Akuffo spoke to Dan McClory about the recently levied tariffs on China steel exports and how it could impact China-U.S. trade.

CGTN America

CGTN America