For now, Beijing and Washington have avoided a trade war. Nevertheless, the U.S. government is working on new ways to tighten restrictions on Chinese investment in the United States. One of those efforts moved forward on Capitol Hill, Tuesday. CGTN’s Jessica Stone reports.

It’s what some are calling Washington’s secret weapon against Beijing’s rising economic power: expanding national security reviews of all foreign investment in the united states.

According to Oxford Economics, a global economic research firm, China trade supports more than 2.5 million U.S. jobs, with 43,000 tied directly to Chinese investment.

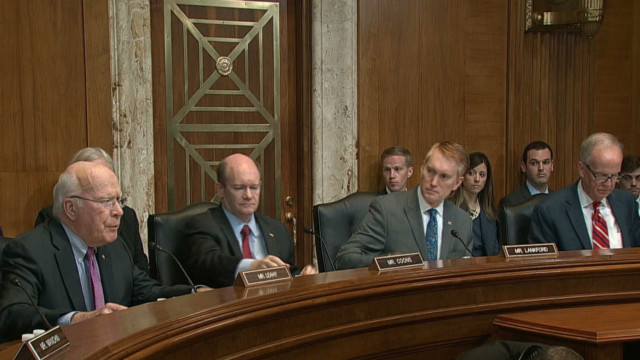

Tuesday, lawmakers approved a bill to expand the types of deals eligible for those security reviews, under the Committee on Foreign Investment in the United States — also known as CFIUS.

“We need to bring CFIUS into the modern age, and i think that’s very important,” said Steven Mnuchin, U.S. Treasury Secretary.

This week, he updated president Trump on ways to curtail Chinese investment in U.S. companies. One such step – is broadening these reviews.

But senators dropped a provision that would require mandatory reviews of any joint venture between an American company and a foreign one, trying to regain support from international companies fearful it would hurt their bottom lines.

After the change, more organizations, which support foreign direct investment in the U.S., backed the proposal.

The proposed law expands national security reviews for foreign investment in real estate near military installations as well those in critical technology and infrastructure companies. But so far, congress is leaving it up to regulators to decide how.

And that has some in congress still worried that the legislation could be used to create an unfriendly investment environment — in the U.S.

“I don’t know. It’s a big step without a lot of vetting,” said U.S. Senator Bob Corker when asked whether the move will prevent foreign direct investment. “We’ll see, there could be some unintended consequences for sure.”

There’s no clear timetable for a final vote on this proposed legislation. But supporters hope it will happen before congress breaks for the August recess.

CGTN America

CGTN America