In May, U.S. President Donald Trump raised tariffs on $200 billion worth of Chinese imports. Now the administration is preparing to impose tariffs on an additional $300 billion worth of goods — essentially all remaining Chinese imports.

Tech giant Apple is among the companies that could get caught in the crossfire of these latest targeted tariffs.

CGTN’s Mark Niu has more.

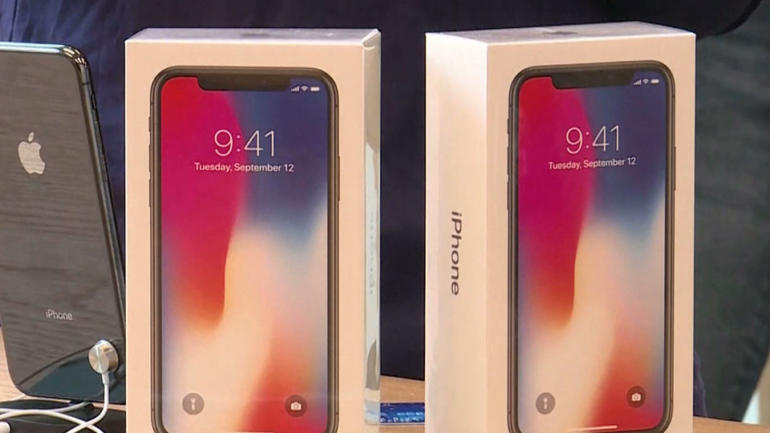

Apple is highly dependent on an extensive supply chain in China. So much so, there are predictions that new tariffs could raise the cost of the iPhone XS by $160.

Investment banking company J.P. Morgan estimated an iPhone price increase of around 14 percent would be needed to absorb the impact of a 25% tariff.

“When it’s actually defined to what are the components being used and things that are in it, I actually think the tariff cost is less than 14% and even lower,” said Tim Bajarin, President of Creative Strategies. “Then Apple could maybe split the difference, they do 7% and to the customer, 7 percent they absorb. Either way, it’s going to affect the customer, and either way it’s going to impact Apple.”

Apple CEO Tim Cook has lobbied the Trump administration in hopes of minimizing the impact of the trade war.

But Bajarin said at the same time, Apple is searching for ways to diversify its supply chain and not just depend on China.

“You can’t do it overnight,” said Bajarin. “One of their big suppliers is already moving what they do for Apple over to Indonesia. Pegatron’s going to do that. You could actually see over the next three years a massive development where the Compals and even the Foxconns expand their factories outside of China, which would be dramatically difficult and a very big problem for China.”

“In every aspect of a trade war, the consumer pays for that,” said Ray Wang, CEO of Constellation Research. “The question is at what level, at what cost? Is it worth getting intellectual property? Is it worth protecting jobs? Is it worth protecting a trade imbalance?”

As the U.S. puts pressure on companies doing business with Chinese tech giant Huawei, there’s also talk of whether China could retaliate by imposing its own tariffs on Apple products.

“Tariffs on Apple products in China would be kind of tough. Here’s the reason. Apple’s sales and shares in China in the market are really low. Samsung’s not even in the market. The local players are doing the best. Apple is like a premium luxury good at the moment, so it’s not the dominant player, dominant OS. Everyone’s picking up local phones,” said Wang.

“The one thing that worries me more is this attitude inside China right now which they look at something like an Apple product or an American product in a very negative way,” said Bajarin.

So while some analysts agree that Apple will be able to weather the trade war’s extra costs, it’s the psychological impact of the tariffs that could prove to be more damaging over the long haul.

CGTN America

CGTN America