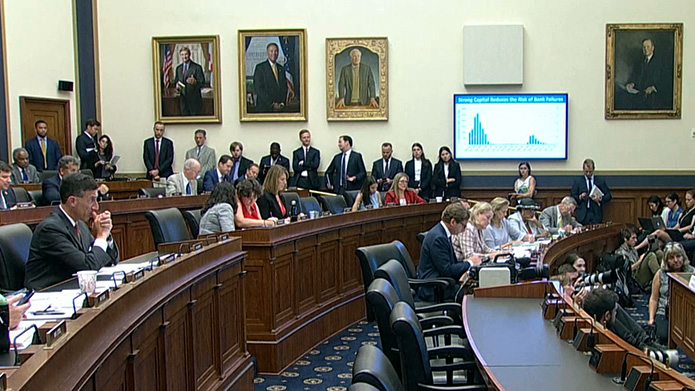

Rate cuts are on the horizon for the United State. In his latest testimony on Capitol Hill U.S. Federal Reserve Chairman Jerome Powell indicated the central bank is likely to cut interest rates. It would be the first rate cut in a decade.

CGTN’s Giles Gibson has the details.

U.S. markets reacted positively to U.S. Federal Reserve Chairman Jerome Powell’s testimony to Congress. The S&P 500 briefly broke through 3,000 mark for the first time ever as Powell signaled a tactical shift.

“At our June meeting, we indicated that in light of increased uncertainties about the economic outlook and muted inflation pressures we would closely monitor the implications of incoming information for the economic outlook and would act as appropriate to sustain the expansion. Since then, based on incoming data and other developments, it appears that uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the U.S. economic outlook,” Powell said.

Those uncertainties mean business investment has flattened off. Throw in weak inflation on top of that and Wall Street now believes an interest rate cut in July is a certainty.

Breaking with tradition, U.S. President Donald Trump has been piling on the pressure in recent months for the Fed to do exactly that.

But many economists believe the Fed and its chairman are immune to outside pressure.

“I know that people parse his words and try to say, well they are or they aren’t going to cut rates, or they’re more likely or less likely, but the rate thing is really just a distraction from what’s going on. The truth is, if they believe the economy is too weak, then they have to do something. If they believe inflation is too much of a risk, then they have to do something. It really just comes down to that,” said Norbert Michel, Director of the for Data Analysis at The Heritage Foundation.

Powell also told Congress that he wouldn’t quit if President Trump asked him to step aside, adding, the law gives him a four- year term and he intends to serve it.

But economic headwinds could push the U.S. central bank to give the president what he wants on rates.

Robert Brusca on US economy Fed Chair Powell’s congressional testimony

CGTN’s Rachelle Akuffo spoke with Robert Brusca, chief economist for FAO Economics, about the U.S. Economy and Fed Chair Powell signaling an interest rate cut.

CGTN America

CGTN America