Zakat is one of the five main pillars of Islam and one that directly feeds into the faith’s emphasis on social justice.

It’s also a hallmark of what Islamic finance tries to do. In fact the system is very dependent on Shariah or Islamic law.

The key feature of Islamic finance is that Allah or God is the owner of all wealth in the world and people are just the trustees.

Humans need to manage that wealth according to God’s commands.

So Islam doesn’t allow for a society where only a small number of people enjoy most of the wealth while a lot of people have very little.

The religion’s financial system also calls for responsible market behavior that benefits the greatest number of people.

One of the main ways Islam tries to establish social justice is seen how some business contracts are drawn up.

When it comes to Islamic finance, the practice of mudaraba is when one partner supplies the capital while the other provides expertise. Both parties share the profit on an agreed upon percentage. But if the investment goes bust, the investor is the one who loses money.

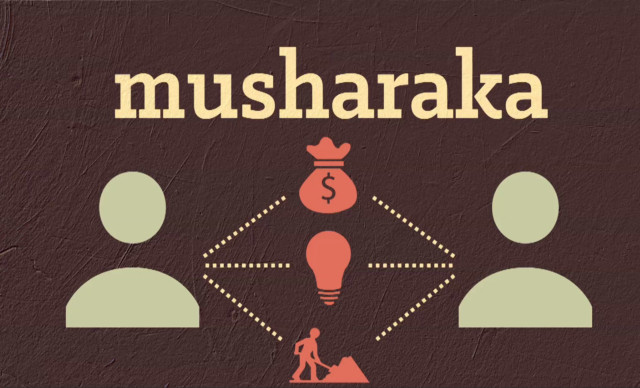

Musharaka calls for two parties to both provide capital, skills and labor. They share the profits and or loss.

In Ijara, a bank buys an asset on behalf of a client- for example a tractor- and rents it out for a fixed payment.

The bank owns the tractor but will gradually transfer ownership to the client when he or she meets all payments. Ljara means rent in Arabic.

Murabaha is an installment credit agreement to buy goods. The seller’s profit is part of the price- but that markup has to be agreed upon by both parties.

Payments can be in a lump sum or installments.

The contracts involve shared risk and make it easier to avoid exploitation.

Professor Hossein G. Askari on Islamic finance

For more about what are the merits of Islamic banking over its conventional peers, CCTV America’s Rachelle Akuffo spoke to Hossein G. Askari, Professor, George Washington University.

CGTN America

CGTN America