The solar industry has been growing at lightning speed in the U.S. and that’s meant exponential job growth. But the recent 30 percent tariff imposed by the Trump administration on solar panel imports is raising fears that growth could come to a screeching halt.

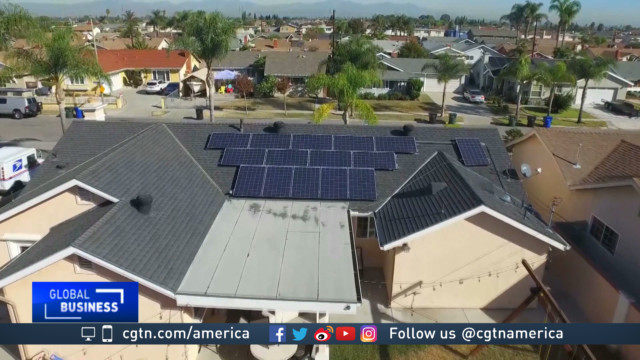

CGTN’s May Lee reports from California, the biggest solar market in the U.S.

Deep Patel started his solar business in his parents’ garage 11 years ago. “Gigawatt” has since grown to 25 employees and regularly enjoys double-digit growth.

But the new 30 percent tariff imposed on imported solar panels by Washington is forcing Patel to make some pricing adjustments.

Gigawatt, however, is expecting a less painful impact because it focuses on residential and small business contracts. An average residential installation will increase by $600 to $1,000. Acceptable, says Patel, if you consider sky-high electricity rates in California.

Patel says, “When I install solar on a homeowner or business owner’s property, we’re competing against their retail rates which are very high so an additional couple thousand dollars isn’t going to kill the return on investment.”

Gigawatt customer and business owner Scott Shone placed his solar order right before the tariff was imposed. He expects a return on investment in less than three years. But Shone says tariffs wouldn’t have deterred him from going solar.

Another reason why the new tariffs will be less painful for companies like Gigawatt is because 70 percent of the solar panels they use are assembled right here in the U.S.

That’s not the case for companies that build multi-million dollar power systems that rely almost 100 percent on imports.

That’s because no U.S. solar panel manufacturers actually make the products needed for huge utility projects. Those panels come from several countries including Malaysia, South Korea, Vietnam and China. Solar panels, Hershman says, are not washing machines.

“This is much different from other trade cases where I would have to ability to buy at maybe a higher cost, but built-in the U.S. if I wanted it. In this case we can’t even buy the product,” says Hershman. “You put that context on the loss…the current model is 23,000 jobs impacted by this tariff. I would argue that it’s likely higher.”

Swinerton Renewable employs 9,000 people across the country, but the company is now preparing to downsize.

“We have six or eight projects that are probably in jeopardy of at least moving out or maybe going away entirely. And those jobs from an employment standpoint range anywhere from 100 to 500 jobs in a rural area.”

The 30 percent tariff is set to decrease by five percent every year and end at 15 percent. But companies like Swinerton are holding out hope this solar tariff will be refined sooner than later, or better yet, be reversed altogether.

CGTN America

CGTN America