The Bloomberg Sustainable Business Summit wrapped up its two-day conference in New York this week.

The annual event brings together business leaders, politicians, and investors committed to sustainability.

This year, cities took center stage a year after the Trump administration pulled out of the Paris Climate Agreement. CGTN’s Karina Huber has more.

In 2017, the U.S. pulled out of the Paris Climate Agreement. The move signaled a reversal from the Obama administration that prioritized fighting climate change.

But many U.S. business leaders and local politicians remain committed to sustainability.

“I mean how do you live on the planet and watch what’s happening and not care? As a furniture manufacturer, who is using a lot of wood, we had a big chance to make a difference by saying we’re only going to buy wood where we know what the chain of custody was – that was sustainably grown,” said Laura Alber, CEO of Williams-Sonoma.

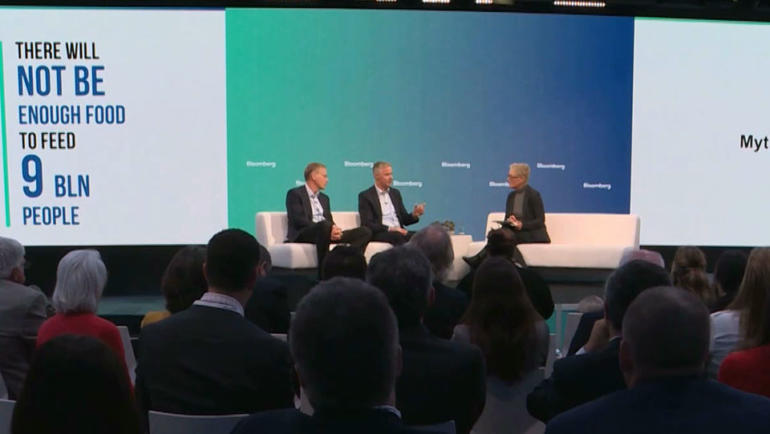

Alber was one of the dozens of speakers from the worlds of business, finance, and politics that took to the stage at the Bloomberg Sustainable Business Summit in New York.

The goal of the meeting was to bring together thought leaders to discuss the risks and opportunities around sustainability.

One of the topics discussed at the summit was focused on cities and the increasing role they are playing in mitigating climate change as well as creating a marketplace for sustainable investment.

“I think cities are trying to fill in the gap. Make sure they step up and lead the way and that really is driven by our constituency. They’re demanding it,” said Esther Manheimer, Mayor of Asheville, North Carolina.

Asheville, a city of roughly 90,000 people nestled in the Blue Ridge Mountains of North Carolina is known for being progressive. It became the first city in the state to issue so-called “green bonds” -debt that backs projects that are positive for the environment.

“What a green bond does for us is it creates a larger investment community. So whereas a traditional bond might just attract a traditional investor, we’re not harnessing those investors that really want to invest their dollars into sustainability,” said Manheimer.

Demand for green bonds has been booming. Last year, municipal green bond issuance in the U.S. hit 11 billion dollars – that’s a 55 percent increase from 2016.

A lot of this investment has been driven by millennial investors for whom sustainability is a high priority. Cleary, the business community and politicians have taken notice.

CGTN America

CGTN America