Around the world, many people pay for goods and services electronically. Businesses and their customers don’t have to worry about having cash. But electronic payment has been slow to take off in Japan. CGTN’s Terrence Terashima tells us about a company that’s working to change that.

Japan, falling behind in the global cashless payments trend, is seeking to increase digital payments to 40 percent of all transactions by 2025. It’s looking to boost productivity amid a labor shortage, and improve transparency so the government can collect taxes more efficiently.

In Japan, 80 percent of people still use cash, and cashless payment methods have been slow to take off. One of the reasons is that Japan already has many prepaid card systems and the majority of people like to keep cash on hand in case of emergencies, such as earthquakes, which Japan in known for. Also, companies are reluctant to introduce new systems due to high commissions.

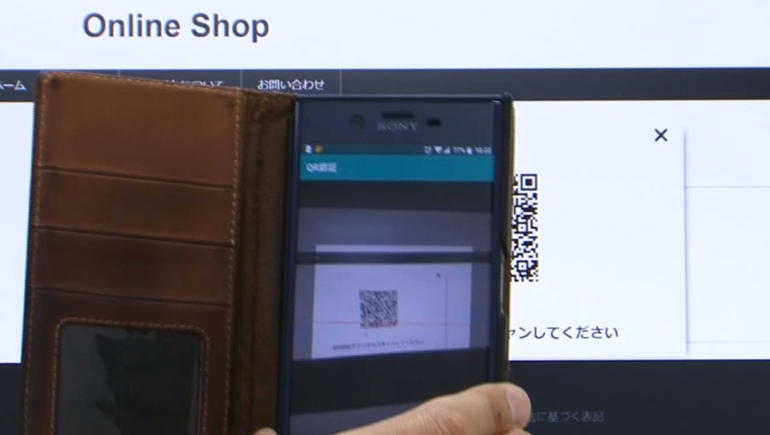

That’s why more attention is being drawn to easy-to-set-up, commission-free QR code payment methods in recent years. But while these bring extra convenience, they’re also an enticing opportunity for criminals, and there have been moves to beef up security in this area. One IT company has developed an authentication system that prevents identity fraud and QR code scams, which they say might also have a wider application in the future.

“The system uses digital signatures which are incorporated into the QR codes,” Hideaki Tanaka, chief technology officer at Triforce Consulting said. “These can insure correct information and prevent any kind of identity fraud or information tampering”

Users do not have to enter a username or password when shopping online or making payments. The newly-developed system provides two-way authentication. QR codes sent by the server can be authenticated with a smartphone app. Each code is unique, and it cannot by stolen or re-used, which means it can be used for a number of applications, such as ticketing, payments and identification.

“This QR code system provides very strong security platforms which in the future can be used for virtual currency transactions or currencies unique to a particular site,” said Tanaka. “It has diverse possibilities”

However, I.T. experts warn that while security technologies are advancing rapidly and the need is imminent, implementing these security systems will take more time. Japanese companies are still slow to recognize the importance of cybersecurity.

CGTN America

CGTN America