There are lots of pessimists out there about the Chinese economy these days. Will China experience a lost decade of zero growth like Japan did in the 90s? Or is China headed for a hard-landing altogether?

Well, people can speculate all they want based on different metrics and methodologies, but we thought it’d be helpful to look at some data, and some new policies coming out of this year’s NPC, China’s top legislature.

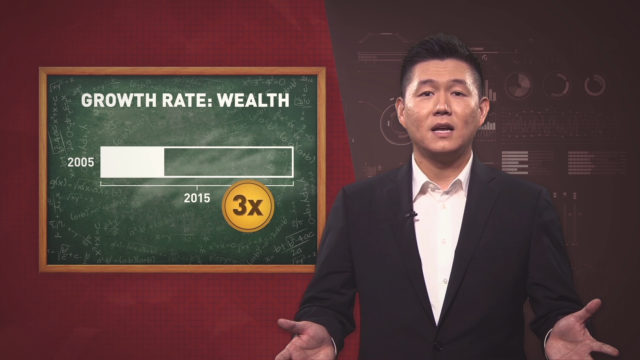

First of all, let’s not forget the Chinese economy is now growing from a much larger base. In 2005, China’s GDP was just $2.3 trillion. Now it’s around 10 and-a-half trillion. 11.3 percent growth in 2005 amounted to more than $255 billion . Whereas 6.9 percent growth last year amounted to $725 billion. So let’s do the math. With half of 2005’s growth rate, 2015 actually produced nearly three times the wealth.

Now at this year’s NPC, China set its 2016 GDP target at between 6.5 percent and 7 percent. Beijing thinks that will be enough to absorb the new labor force coming into the market.

You may have noted that this is the first time China set a range not a specific number. That’s expected to discourage goal-obsessed local authorities from massaging their data to meet the target.

Export is another component of China’s GDP. After missing last year’s trade target, this year the Chinese Premier did not even bother setting a trade target. And many economists think that was a realistic move. After all, in an interdependent global economy it’s hard enough to control one’s own economy, let alone the rest of the world’s.

Now the question is: how will the Chinese government respond to its slowing growth? Will there be more stimulus? The answer is yes, and no.

At this year’s NPC, Beijing says it WILL use fiscal stimulus to help growth. The budget deficit will increase from 2 percent to 3 percent of the GDP. But it’s a different sort of stimulus.

In the past, government spending largely went to state-financed infrastructure projects. This time, the stimulus will mainly come from a $77 billion tax cut.

So a high-tech start-up in Beijing, or an Internet company in Guangzhou, ideally, should have more money to expand and hire. A concept Beijing calls “supply-side economics.”

On the monetary side, China will also increase money supply to 13 percent, up from 12 percent.

Of course, there needs to be government oversight to make sure

this extra cash mainly gets invested where it can do the most good—in small businesses that can create more jobs.

Figures are represented in 2015 U.S. dollars

Read more:

Chinese Subtitle Version:

CGTN America

CGTN America