Barbados made history recently when its government announced that the island-nation executed the world’s first debt-for-climate-resilience swap.

The groundbreaking initiative converts the country’s national debt in exchange for biodiversity conservation through the Inter-American Development Bank, the Green Climate Fund, and a number of regional banks.

The plan allows the country to navigate the dual challenges of debt distress and climate change.

Barbados is currently facing a water crisis where available water is currently four times lower than the global average. This has put great strains on agricultural productivity and human consumption.

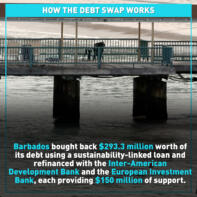

To make the swap work, Barbados bought back $293.3 million worth of its national debt using a sustainability-linked loan and refinanced with the Inter-American Development Bank and the European Investment Bank, each providing $150 million of support.

Sustainability targets are embedded in the loan agreement, and failure to meet these targets will result in financial penalties for the government.

The savings generated from refinancing, $125 million, will go towards funding upgrades to the island’s water and sewage treatment plants such as the New South Coast Water Reclamation and Reuse Facility, which is projected to more than double the island’s water supply by 2050.

Other funds will also go towards food security and environmental protection.

The initiative sets a precedent for other nations to adopt this type of climate financing.

MODEL FOR OTHERS

Barbados Prime Minister Mia Mottley, a prominent advocate for climate finance, emphasized the significance of her country’s swap in addressing the pressing needs of climate-vulnerable nations.

Debt-for-climate swaps are emerging as a viable tool for addressing the $359 billion annual funding gap identified by the United Nations for climate adaptation in developing nations.

Similar agreements in Belize, Seychelles, and Ecuador highlight the growing use of this mechanism. For example, Ecuador recently leveraged a blue bond — a debt product that raises funds for ocean and marine projects — to protect the Galapagos Islands.

Countries implementing such swaps often experience improved sovereign credit ratings, reduced borrowing costs, and enhanced resilience against climate impacts.

Studies show climate-induced disasters disproportionately affect nations least equipped to manage them, further deepening economic disparities.

LIMITATIONS

While the swaps are promising, some have raised concerns about its impact. For example, the amount of national debt removed in the Barbados swap, $293 billion, is only about 5 percent of Barbados’ national debt, which was about $7.48 billion in 2023.

Such swaps also require strong governance, transparent monitoring, and long-term commitments to sustainability goals. Any missed performance targets could incur financial penalties.

Critics also say greater involvement is needed from developed nations and multilateral institutions. Current global climate finance commitments fall short of the $3 trillion to $6 trillion annual investment needed to meet the Paris Agreement goals.

CGTN America

CGTN America