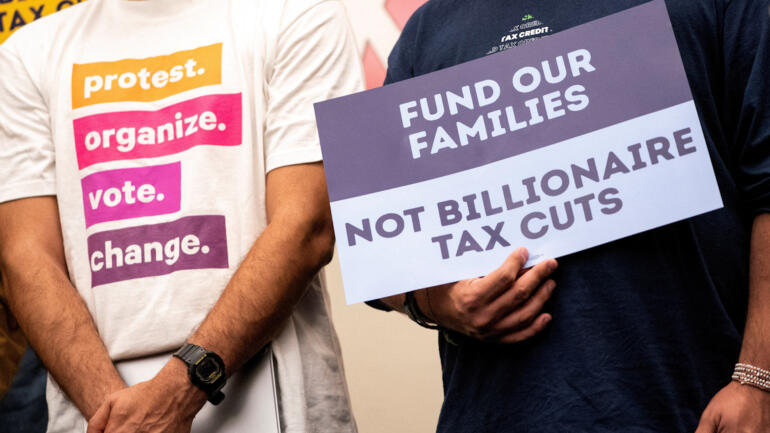

President Trump’s tax bill, which he calls “One, Big Beautiful Bill” aims to deliver historic tax cuts for Americans and introduce reforms to federal programs like SNAP, which runs the food stamp program, and Medicaid. Trump supporters say the bill will spur economic growth and will not add to the deficit.

However an analysis by the U.S. Joint Committee on Taxation estimated that the bill could cost the country $3.8 trillion over the next decade. While the bill is still in its early stages, some economists and policy experts are warning that the outlook for the poorest Americans may not be beautiful at all.

Wealthier Americans are expected to benefit the most under the proposed GOP tax plan. According to new estimates from the right-leaning Tax Foundation, the top 5% of earners could see their after-tax income increase by 4.4% by 2026. Middle-income earners would receive a smaller boost, while those in the bottom 20% would see just a 2.4% gain.

Workers earning overtime or who get their wages in tips will get new tax breaks under the bill. The bill also proposes a higher standard deduction, offering broader tax relief to many Americans across income brackets. However some policy experts are concerned that low- and moderate-income families could face disproportionately higher costs from new tariffs, offsetting any tax savings they receive.

Seniors could see some gains. Instead of fully eliminating income taxes on Social Security benefits, the bill proposes a temporary increase in the standard deduction for taxpayers over age 64.

Low-income Americans are likely to be hit the hardest by the proposed tax bill. According to the U.S. Joint Committee on Taxation, taxpayers earning less than $15,000 a year would face a collective tax hike of nearly $1 billion, an 18.7% increase. Nearly all income groups above that level would receive some form of tax cut.

The bill also imposes significant costs on vulnerable populations. The Trump administration argues that only ineligible recipients, such undocumented immigrants and those who don’t work but can, would lose Medicaid and SNAP coverage.

However a recent study by the Penn Wharton Budget Model shows that households in the bottom income quintile could lose an average of $28,000 in lifetime value due to the program cuts in the bill. By contrast, high-income households would gain an average of $30,000 in tax benefits.

CGTN America

CGTN America